sacramento property tax rate 2021

View the Boats and Aircraft web pages for more information. Equalized Assessed Valuation by Tax Rate Areas.

Proposition 13 And Real Property Assessments

2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918.

. PO BOX 942879 SACRAMENTO CALIFORNIA 94279-0064. The Sacramento average property tax rate for 2022 is 81. How much is Sacramento property tax.

2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

Notice that 2021-2022 tax rates were used since 2022-2023 values are not available yet. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. The 2021-22 assessment roll will generate approximately 19 billion in property tax revenue.

The sacramento sales tax rate is. Privately and commercially-owned boats and aircraft are also subject to personal property taxes. PROPERTY TAX DEPARTMENT.

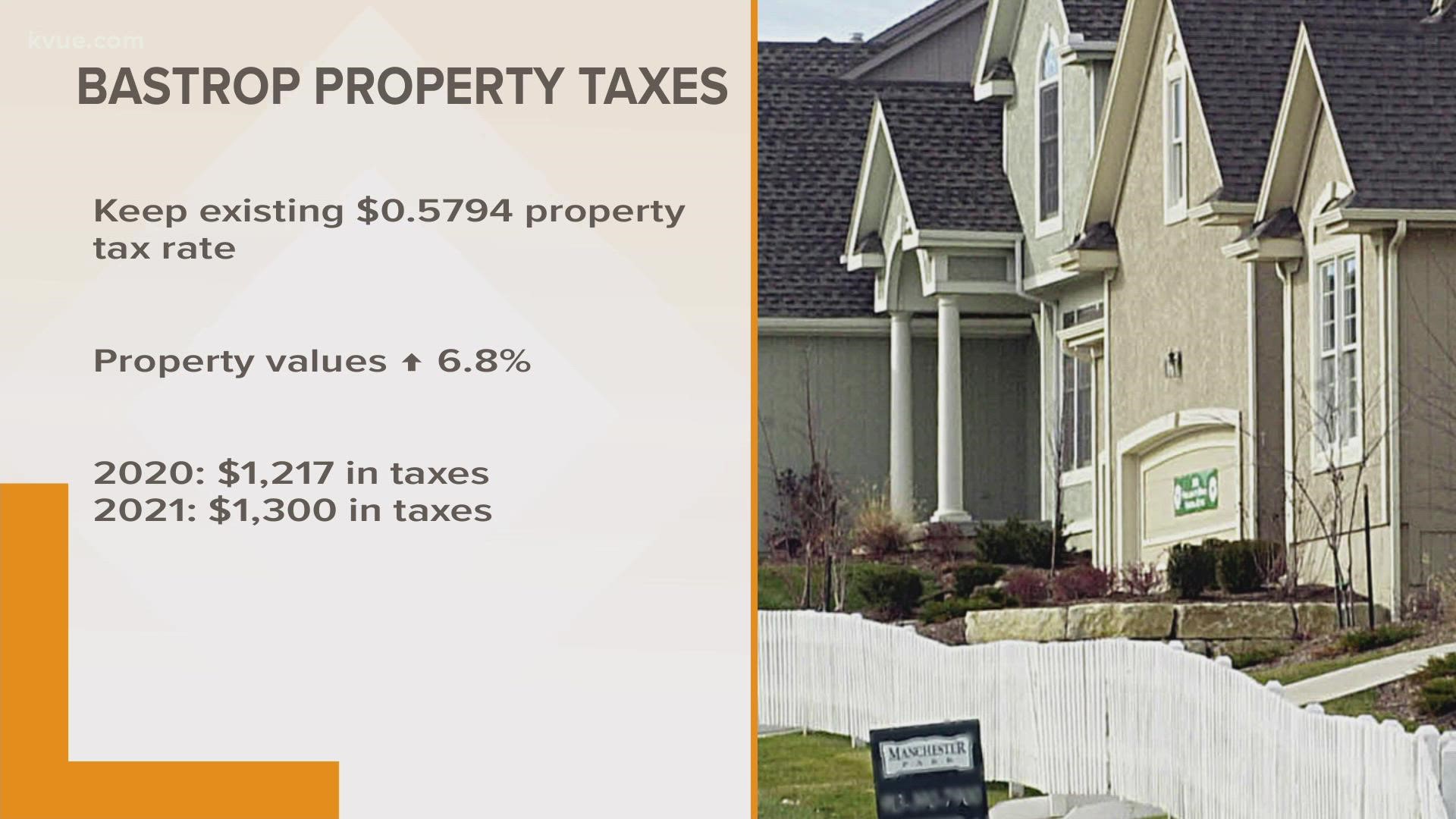

Sacramento property tax rate 2021. Tax description Assessed value Tax. When calling the Tax Collectors Office your call is answered by our automated information system.

Tax bill amounts due dates direct levy information delinquent prior year tax information and printable payment stubs are available on the Internet using your 14-digit parcel number at e. California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and.

Fiscal Year 2020-202 1. 450 N STREET SACRAMENTO CALIFORNIA. In-depth Sacramento County CA Property Tax Information.

The assessment roll is the total gross assessed value of locally. This years roll growth will yield an additional 97 million in revenue over last year. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the.

3636 American River Drive Suite 200 Map Sacramento CA 95864. Sacramento Property Tax Rates. View the E-Prop-Tax page for more information.

Annual bills for Sacramento County unsecured personal property taxes for fiscal year 2021-2022 will be mailed on July 16 2021 and are. Some property owners in san diego city have a 117461 tax rate while some in chula vista have a rate of 114221. The median property tax on a 32420000 house is 220456 in.

Sacramento County collects on average 068 of a propertys. Permits and Taxes facilitates the collection of this fee. Thursday July 15 2021.

What is the sales tax rate in sacramento california. Available 24 Hours a day 7 days a week 916 874-6622. The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties.

Property Tax Administrative Fees - SB 2557. Automated Secured Property Information Telephone Line. 2021-22 Sacramento County Property Assessment Roll Tops 199 Billion.

Payments may be made by mail or in person at the county tax collectors office located at 700 h street. 916-875-0740 or e-m ail.

What Is The Difference Between Assessed Value And Appraised Value Sacramento Appraisal Blog Real Estate Appraiser

U S Cities With The Highest Property Taxes

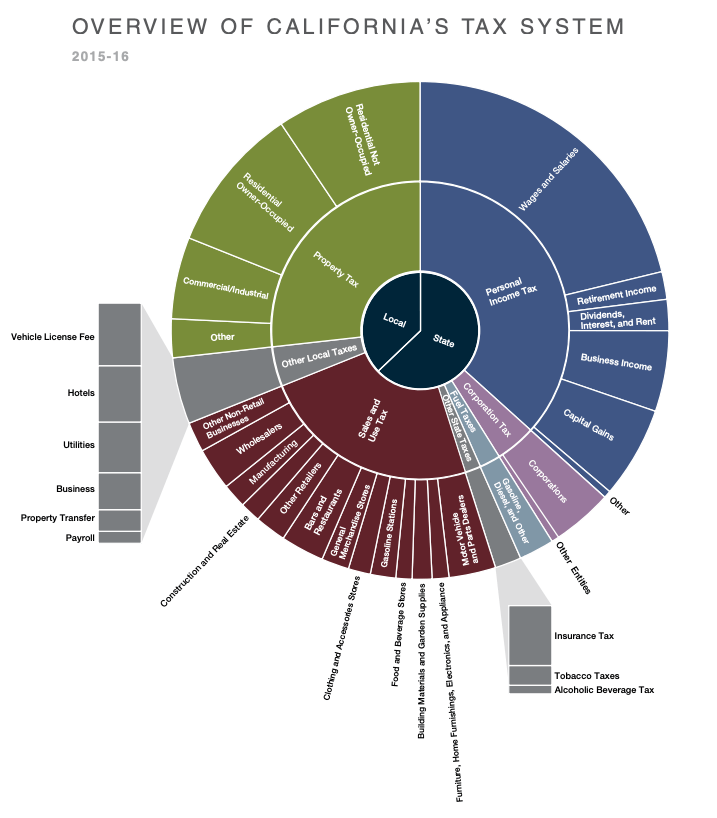

California Tax Rates Rankings California State Taxes Tax Foundation

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Here Is Your The Ultimate Guide To Real Estate Taxes

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

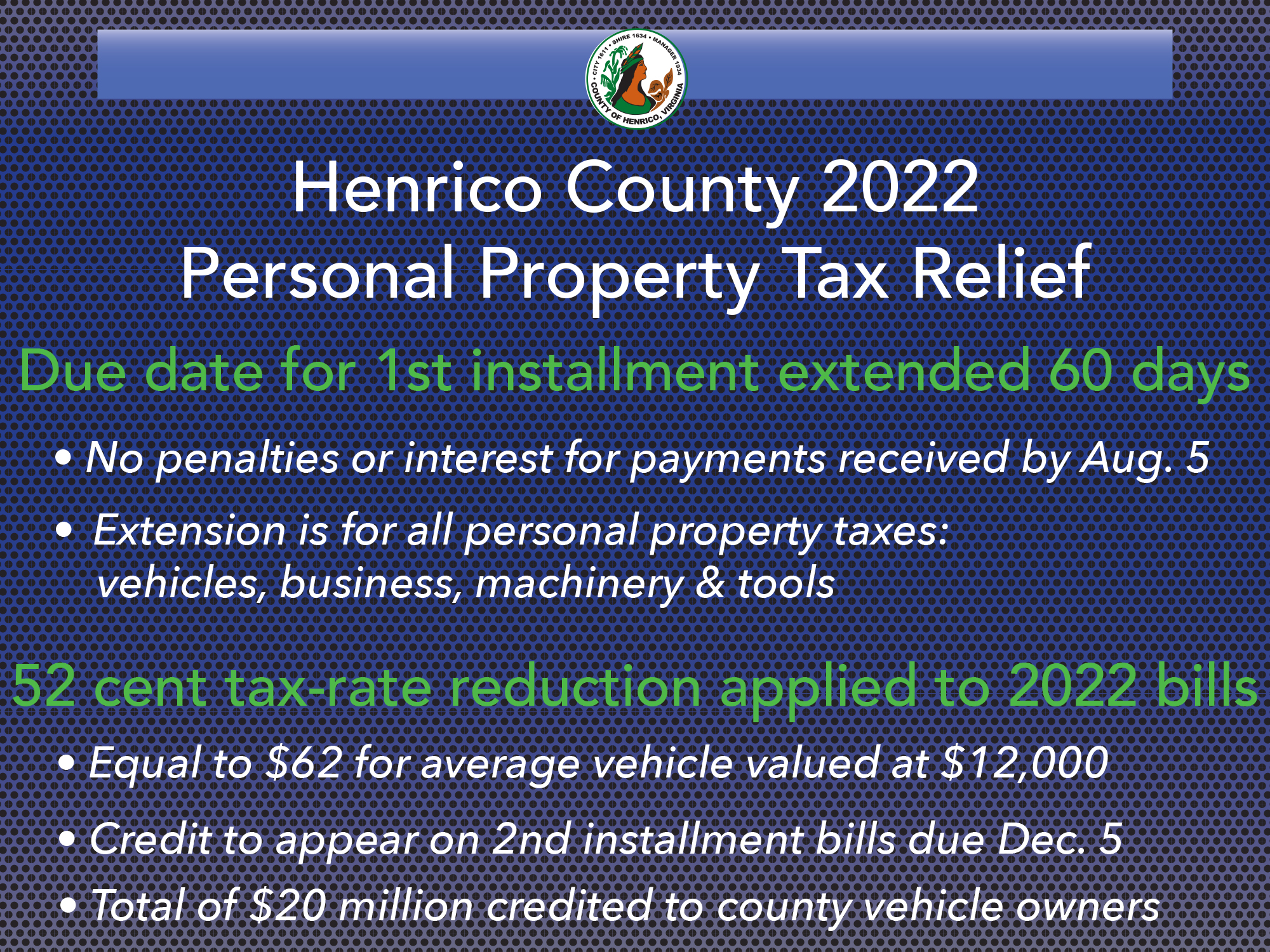

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

U S Cities With The Highest Property Taxes

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Texas Property Taxes By County 2022

California Sales Tax Rates By City County 2022

Where Do People Pay The Most In Property Taxes

Sacramento County Housing Indicators Firsttuesday Journal

Yuba County Ca Property Tax Search And Records Propertyshark

Pennsylvania Property Tax H R Block

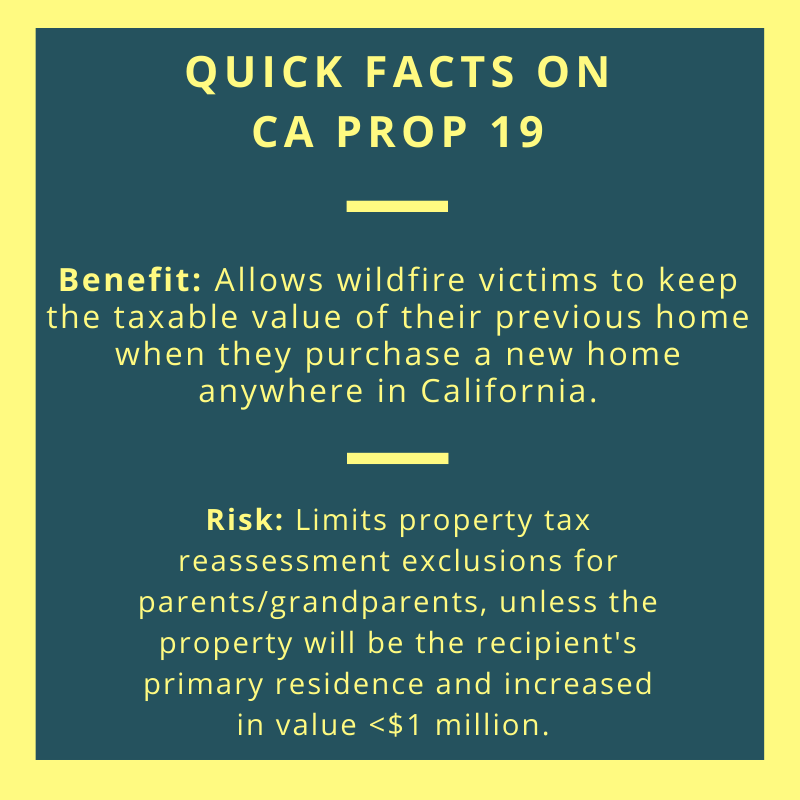

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt